Reasons UHNWIs Join Peer Groups

No Whining on the Yacht (But You Can Talk about the Voyage)!

If you are someone who has created significant wealth, you have put yourself in the wonderful position of having financial security and the ability to do many things. You may even buy a yacht…but no whining on it! And while you might be thankful for being in such a position, success and wealth not only create opportunities, they also can present challenges.

Can you talk frankly with your closest friends and family about your wealth in an honest and open way? They may not be in the same financial situation, nor in a position to offer much guidance or understanding of the challenges associated with wealth. The solution may be to join a peer group of other wealth creators that talk about key life topics in a confidential setting, allowing members to share, learn, and help one another. Below are some of the issues that you night tackle in a peer group of wealth creators:

You Sold or Exited Your Business – What’s Next?

Perhaps you had a recent liquidity event and are deciding what to do next…Should you start another company or become an angel investor? Maybe you have been CEO or a senior leader at a business for a number of years and want to get a better work-life balance, or are interested in doing more philanthropic work… possibly through your own foundation? Learn more about Life After Selling a Business here.

There can be many catalysts for joining a peer group of successful wealth creators, and almost certainly your life journey will present you with other opportunities and challenges where trusted advice and insight can be hugely valuable to you.

Establishing Work-Life Balance

Perhaps the most common challenge successful people have is finding and maintaining the right balance between their work and personal lives. There are simply too many quality things to do and not enough time to do them. Money is not the limiting factor – time is. There is no silver bullet solution to solving the time shortage, but it can be incredibly helpful to talk through how you allocate your time versus what you consider the most important. Priorities may change over time, sometimes drastically, making it important to recalibrate and reprioritize regularly. It can also be helpful to ask the question, “Does what I am prioritizing match up with how I want to be remembered?” Hearing diverse perspectives from peers can be very powerful.

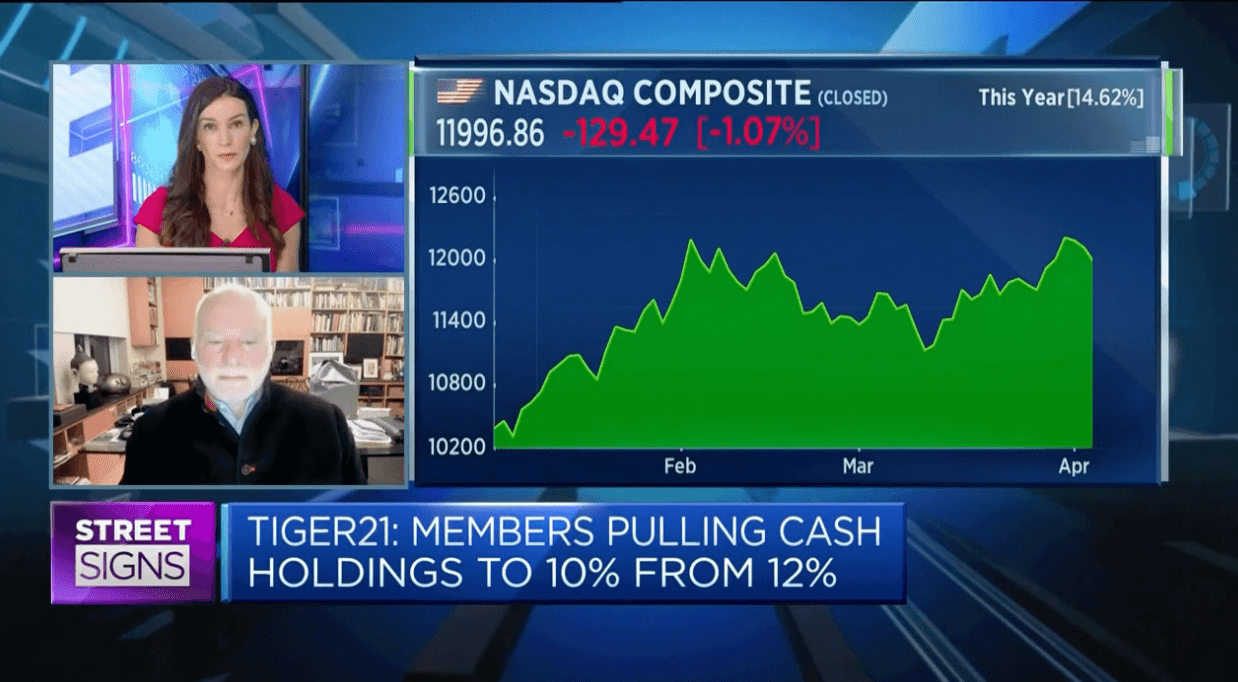

High-Net-Worth Estate Planning & Investing

Creating wealth is very different from protecting and managing wealth. Wealth creators can find themselves unprepared and confused when it comes to estate planning and investing. Things are made even more difficult by the complex and ever-changing rules and tax laws related to trusts and estates. Moreover, the number of choices of structures and service providers is nearly endless. While you need to make your own choices for you and your family, it is incredibly helpful to hear how others have approached estate planning and wealth management. Also, listening to experts who give educational talks about relevant topics before you make any commitments is a great way to navigate things.

Focusing on Health & Wellness

What good is having money if you aren’t healthy enough to enjoy it? Health & wellness is often an underappreciated aspect of busy peoples’ lives. Beyond the basics of eating healthy and getting exercise, there are always new and interesting topics to explore about how you can feel better. Would you like to hear from an expert on sleep, or someone that coaches meditation? What is longevity medicine? What are the best centers of excellence for a certain medical condition? How far are we from getting laboratory grown meat on our dinner plates? Hearing about various health & wellness topics from expert speakers, and having the opportunity to ask questions and participate in an in-depth discussion, can be helpful.

UHNW Individuals and Family Issues

If your career has been a great success, perhaps the thorniest issues you face involve your family relationships. Staying tuned in with your spouse and children can be trying when you are working to grow a business, putting in long hours, and traveling. Wealth itself sits on the fine edge of being a positive or negative influence on your kids, as you want them to feel secure and supported, but not spoiled and unmotivated. Other extended family members may be struggling financially, and you want to offer support, but how best do you provide it? These are all very complicated issues to handle. No one has all the answers ahead of time, but the ability to hash it out with others facing similar issues can be quite powerful and anchoring.

Philanthropic Giving

Philanthropy is a natural progression for those who have created wealth. It can be an opportunity to make changes related to issues you care about, or perhaps help people that are less fortunate. You may want to simply find the best philanthropic organizations focused on your areas of passion, and support those. Or you may have a specific or unique goal in mind and decide to create your own charitable organization. The ability to talk about your values and goals with others, and then ideate about how best to pursue philanthropic work can be very helpful in your personal philanthropic journey.

Consider Joining a Peer Group: TIGER 21

If you have created significant wealth for yourself and one or more of the topics above resonate with you, it may make sense to join a peer group of like-minded individuals that can help one another by sharing, learning, discussing, and advising. Collective knowledge and wisdom are the most powerful, and creating deep, lasting friendships with other high-performing people can be incredibly rewarding. Consider a facilitated peer group that explicitly tackles issues related to work-life balance, family issues, estate planning, health & wellness, philanthropy, and many other important and interesting topics. TIGER 21 offers just this, and you will not only be part of your own local group, but also part of a global network of 1300 wealth creators. Success is just the beginning.

About the Author

Pete Wilson is a TIGER 21 Chair in the San Francisco Bay Area, well as a seasoned investor and business advisor. He has led teams in capital markets and institutional investment management for more than 25 years, working with BARRA, Montgomery Asset Management, BGI and BlackRock.

Connect with Pete Wilson on LinkedIn. If you are located in San Francisco and are interested in learning more about the local TIGER 21 Group and Chapter activities, click here.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports