Diversifying Your Portfolio with Alts | Barron’s Article Features TIGER 21 Founder

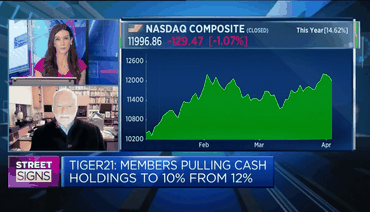

In the current economic downturn, many investors are looking to alternative investments, also known as alts. TIGER 21 Founder and Chairman Michael Sonnenfeldt offered insights in Lewis Braham’s article “How to Diversify Your Portfolio With Alternative Investments.”

Alts tend to perform differently from stocks and bonds, which allows investors the opportunity for return as the public markets remain down this year. Types of alternative investments include “liquid alts” as well as private or semiliquid public vehicles. Liquid alts, which function similarly to traditional mutual or exchange-traded funds, offer benefits such as daily redemptions but could also deliver lower returns.

Investors must also keep in mind the wide variance in returns among different alts and their barrier to access. Nonetheless, private equity and debt remain attractive to high-net-worth investors, including Members of TIGER 21, whose second-quarter portfolios this year consisted of an average of 27% in private equity. Many individuals are also looking to invest in private credit through business development companies, which has become increasingly popular among TIGER 21 Members, according to Michael Sonnenfeldt.

Those interested in investing in alts should consider their wealth, risk profile, and other categories before choosing where to invest, but while alts require more thorough research, alternative investments can provide much opportunity in today’s economic climate.

Read the full article to learn more.

About TIGER 21

TIGER 21 is an exclusive global community of ultra-high-net-worth entrepreneurs, investors, and executives.

Explore the TIGER 21 Member ExperienceMember Insight Reports